Agar aap naukri ya business karte hain, yaani agar aap earn karte hain, to aapne Taxes ke baare me zaroor suna hoga.

Iss article me hum na sirf jaanenge ki Taxes kya hote hain, magar:

- Taxes kyon pay karne padte hain?

- Kya hoga agar aap tax pay nahi karte hain?

- Taxes kitne types ke hote hain?

- Income Tax kya hota hai?

- Aap kaise eligible hai income tax pay karne ke liye?

- Slab kya hoti hai?

- Income tax return kya hoti hai?

- Old aur new regime me farak

- Tax pay karne ke hume faayde kya hote hain?

Taxes kya hote hain aur kyo pay karne padte hain?

Tax ek aisa amount hota hai ko aapko apni government ko pay karna padta hai. Iss amount se government road constructions, school buildings ki construction, health care, education etc. jaisi suvidhaayein hume provide karti hai. Taxes ke madhyam se government ka aim hota hai country me reh rahe logo aur uski economy ki bhalai karna. Isliye, jo bhi tax bharne ke liye eligible hain, unke liye tax bharna zaroori hota hai.

Kya hoga agar aap tax pay nahi karte hain?

Agar aap ya aapka business eligible hain aur tax nahi pay karte hain, to law ke under aapko iske consequences ko jhelna pad sakta hai.

Taxes kitne types ke hote hain?

- Direct taxes: Tax directly government ko pay kiya jata hai. Examples: Income tax, Corporate tax, etc.

- Indirect taxes: Ye tax goods and services par apply hota hai. Examples: GST (Goods and Services Tax), VAT (Value Added Tax), aur directly nahi jata government ke paas.

Income Tax kya hota hai?

Ab hum baat karenge ek aise direct tax ki jo hum sab par ya to already lagoo hota hai ya fir kabhi na kabhi zaroor hoga. Hum discuss karenge income tax ke baare me.

Income tax ek aisa direct tax hai jo eligible citizens government ko directly pay karte hain. Har saal hamari jo income hai, uska ek hissa government ko jaata hai.

Aap kaise eligible hai iske liye?

Income tax pay karne ki kuch slabs hoti hain. Aap eligible (yogya) tab honge jab aap us payable income tax slab ke under aenge. Agar aapki income government ki tay kari gayi slab se kam hai, to aapko ye tax pay karne ki avashyakta nahi hai. Magar haan, jaise jaise aapki income badhegi, vaise vaise aapka tax bhi badhta jayega.

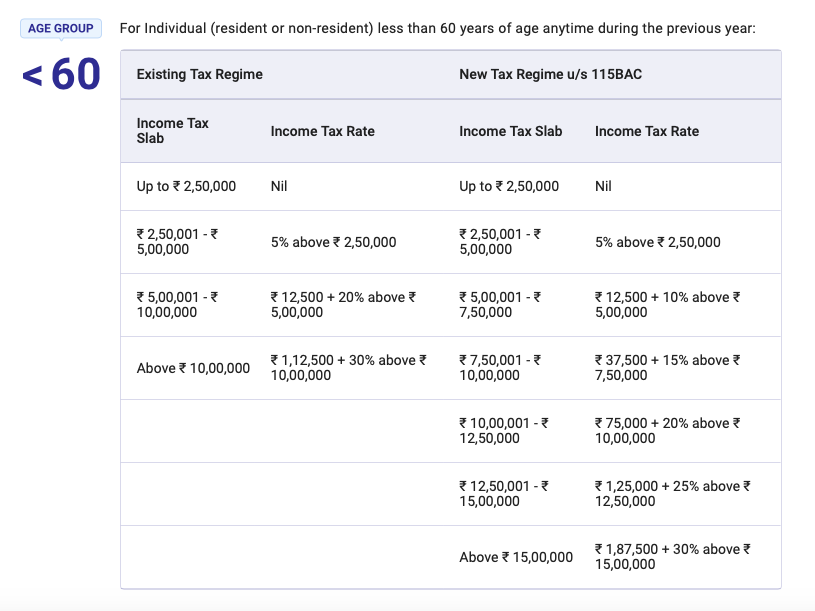

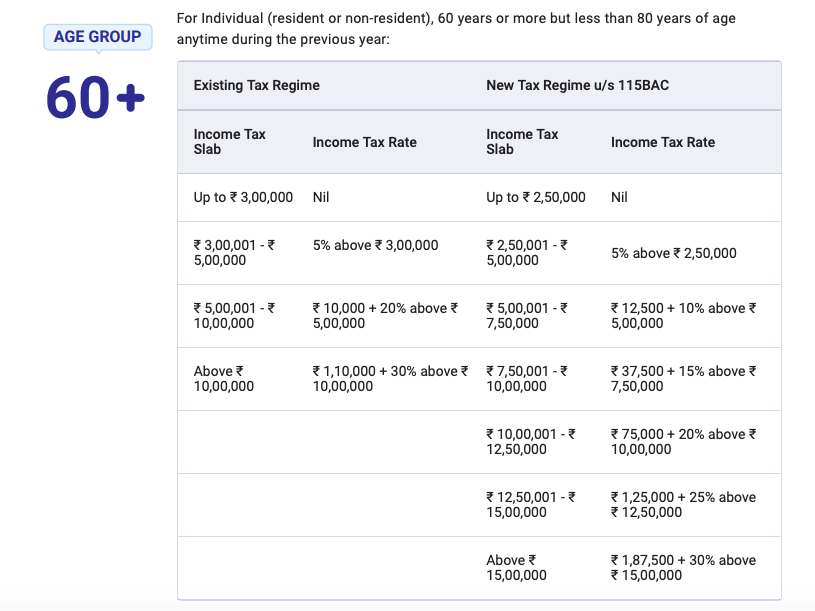

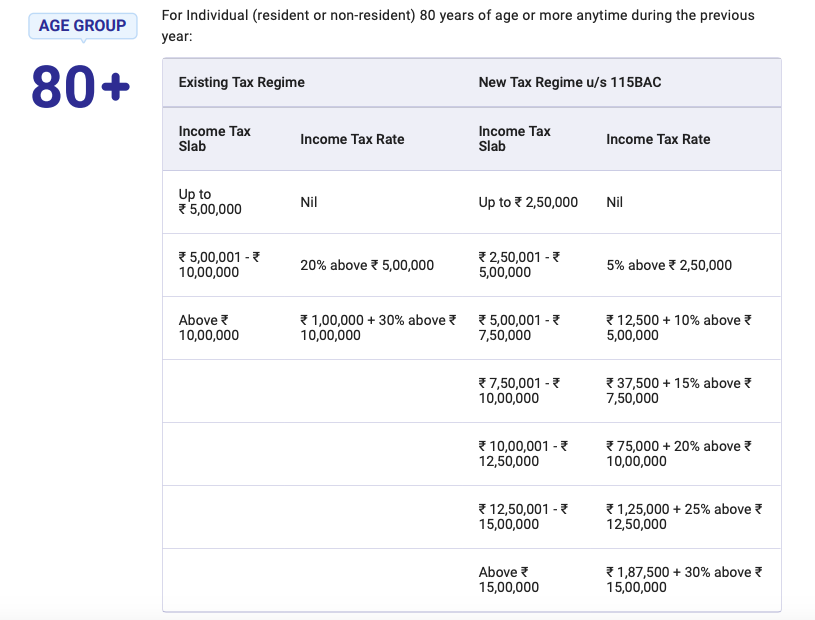

Slab kya hoti hai?

Government ne hamari income ko ranges (shreniyon) me divide kar diya hai. Jaisa ki humne oopar discuss kara, jaise jaise aapki income badhegi, aapka tax amount bhi badhega. Aisa isliye hota hai kyonki aapki income jis range me a rahi hai vo change ho jati hai.

2 tareeke ke systems ya regimes humein dekhne ko milte hain – Old and new regime. Dono regimes me thoda bahut difference hai.

But pehle discuss karte hai ki Income Tax Return kya hoti hai?

ITR ek form hota hai jo hum Income Tax department ko submit karte hain. ITR form hum har financial year ke according bharte hain au risme hamari income ki details hoti hai jsike according ye pata chalta hai ki hume kitna tax bharna hota hai.

Old aur New Regime me farak

Source: Income Tax e-filing

Source: Income Tax e-filing

Source: Income Tax e-filing

Aap apni suvidha and choice ke hisaab se ek regime choose kar sakte hain. Aap jab ITR ya Income Tax Return bharenge, to aapki return isi choice ke according banegi aur aapko rebate usi ke according milega.

Tax pay karne ke faayde?

In sab reasons ke alawa, tax bharne ke hume aur bhi kayin faayde hote hain. Tax bharne se humein:

- Loan apply karne par banks aapse ITR ki copy mangte hain. ITR hone se aapko loan aasani se mil jati hai because banks ko pata chalta hai ki aap ek yogya insaan hai

- Visa application approve hone me aasani

- Aapko pata chalta hai ki aap tax refunds receive karne ke liye eligible hai ya nahi

- ITR aapke address and income ka ek proof hoti hai