Hum mein se bahut se log aise bhi honge jo ya toh apna khud ka business kholna chahte hain ya apne pehle se established business ko expand karna chahte hoge. Lekin bahut se log aise hote hain jinke paas ya toh apna khud ka business shuru karne ke liye ya pehle se hi established business ko expand karne ke liye funds yani paiso ki kami hoti hai. Iss situation mein aap apne business ke liye loan le sakte hain. Par kya aap bhi confused hain ki apne business ke liye loan kaise le? Toh aaj hum aapko batayenge business ke liye loan in Hindi se judi puri jaankari.

Iss article mein hum aapko batayenge-

Business ke liye Loan kaha se le

Business Loan ke liye Eligibility Criteria

Business Loan ke liye Documents

Business Loan ke liye apply kaise kare

Business Loan ke liye best banks

Business Loan kya hota hai

Agar aap koi dukan, retail shop, wholesale, distributorship ya kisi bhi prakar ka khud ka business kholna chahte hain ya apni pehle se established business ya naya business shuru karna chahte hain aur iske liye apke pas paiso ki kami hai toh aap loan le sakte hain. Business ke liye leeye gaye loan ko Business Loan kaha jata hai. Jab aap business loan lete hain, toh yeh ek tarah se udhaar hota hai jisse aapko interest yani ki byaj ke sath lautana hota hai.

Business loan lene ke fayde

Business ke liye loan in hindi toh aap jaan hi chuke hain par kya aap jaante hain ki aap apne business ke bahut se purposes ko pura karne ke liye loan le sakte hain jaise-

- Apne business ka Cash flow badhane ke liye

- Technological upgradation ke liye

- Apne business ke liye naye tools aur machines khareedane ke liye

- Inventory yani ki stock ko badhane ke liye

- Seasonal Workers hire karne ke liye

- Bade orders ke liye raw material khareedane ke liye

- Dusre shahar mein business ko expand karne ke liye

- Apne business ke operations ko badhane ke liye aur naye projects par work karne ke liye.

Business ke liye Loan kaha se le

Business Loans ko 3 factors ke basis par categorise kiya jata hai. Ek entrepreneur ke liye ye janana zaruri hai ki kitne types ke business loans hote hain aur business requirements ko dhyan mein rakhte hue hi usse sahi type ka loan lena chahiye. Toh aaiye jaante hai ki kitne prakar ke business loans hote hain aur business loans hum kahan se le sakte hain-

- Government Schemes se business loan le

- Bank se kaise loan le in Hindi

- Women Entrepreneurs ke liye business loan schemes

- Government Schemes se Business loan le

Jahan par Government schemes ki baat aati hai toh sabse pehle hum baat karte hain MSME yani Ministry of Micro, Small and Medium Enterprises.

MSME Sector pichle 5 saalo mein Indian Economy ka sabse dynamic aur vibrant sector saabit hua hai. MSME sector Government of India ke under aata hai aur yeh concerned Departments, State Governments aur Stake holders ki cooperation ke sath existing enterprises ko support karta hai aur new enterprises ko encourage karta hai. MSME bhi apni kuch schemes ke through business loans provide karta hai jaise Credit Guarantee Scheme, Coir Udyami Yojana etc.

MSME se judi zyada jaankari ke liye aap inki official website par jaa sakte hain.

Indian Government dwara small businesses aur start-ups ko promote karne ke liye bahut si schemes banayi gayi hain jiske dwara ek entrepreneur loan le sakte hai. Toh aaiye jaante hai aisi hi kuch government schemes ke baare mein-

The Credit Guarantee Scheme (CGS)

Government of India dwara CGS ko Micro aur Small enterprises ke liye launch kiya gaya hai taki inn sectors ko bina kisi collateral ke credit (loan) ki facility provide ki jaye. Iss scheme ke under nayi aur existing dono types ke businesses ko cover kiya jata hai. Yeh scheme Micro Enterprises aur first generation entrepreneurs ko small business loans reasonable rates par provide karti hai. Iss scheme ke under loan ka amount applicant ki eligibility aur unke business ki feasibility par depend karta hai. Iss scheme ke under maximum limit 1 crore ki hai.

Credit Guarantee Scheme ka eligibility criteria jaanane ke liye yahan click karein

MUDRA Loan Scheme

Mudra (Micro Units Development and Refinance Agency Ltd) scheme ka purpose hai micro units aur non corporate small business sectors ko business loans provide karna. Iss scheme ke under loan lene ke liye collateral ki zarurat nahi padti. MUDRA loan scheme ke under aap inn types ke loans ka benefit le sakte hain-

Shishu- Iss plan ke under aapko Rs 50,000 tak ka loan bina collateral ke milta hai jis par 1% interest rate/per month hota hai aur loan ka amount 5 saal baad repayable hota hai.

Kishor- Iss plan ke under aapko Rs 50,000 se lekar Rs 5,00,000 tak ka loan milta hai.

Tarun- Iss plan ke under aapko Rs 5,00,000 se lekar Rs 10,00,000 tak ka loan milta hai.

Mudra loan ko business ke stage aur funding needs ko dekhte hue diya jata hai.

Mudra Loan Scheme ka eligibility critera jaanane ke liye yahan click karein.

Stand-up India Scheme

Stand-up India Scheme mein at least 1 Scheduled Caste (SC) ya fir Scheduled Tribe borrower ko Greenfield enterprise set up karne ke liye Rs 10,00,000 se Rs 1 Crore tak ke beech ka loan diya jata hai. Stand-up India ek special Government scheme hai jo SC/ST aur women entrepreneurs ko financially empower karne ke liye loan provide karti hai. Loan ki repayment ka period 7 years hota hai.

Stand-up India Scheme ka eligibility criteria jaanane ke liye yahan click karein.

Coir Udyami Yojana

Iss scheme ke under across India coir units set kiye jate hain. Yeh scheme Rs 10,00,000 aur ek cycle ke working capital ke beech shuru kiye gaye projects ke liye funding karti hai. Iske under provide kiye gaye funds yani loan total project cost ke 25% ko exceed nahi karne chahiye. Iss scheme ke under loan ki repayment 7 saalo mein karni hoti hai.

Coir Udyami Yojana ka eligibility criteria jaanane ke liye yahan click karein.

National Bank for Agriculture and Rural Development (NABARD)- NABARD ek development bank hai jiska aim hai loan aur anya facilities provide karna aur Agriculture, Cottage aur small industries, village industries ko develop karna. NABARD rural areas mein loan provide karta hai.

NABARD se judi zyada jaankari ke liye aap inki official website par jaa sakte hain.

2. Bank se Loan kaise le in Hindi

Ab aap yeh toh jaan chuke hai ki government ke schemes jaise ki mudra loan etc ke through aap apne business ke liye loan kaise le sakte hai. Toh aaiye ab jaante hain ki Bank se loan kaise le in hindi-

Overdraft

Jaisa ki naam se pata chalta hai, overdraft ka matlab hai apne current account se overdrawing karna. Iss facility ko avail karne ke liye aapko ek fixed interest rate par charge kiya jayga. Agar aap apne account se overdraw nahi karte toh aapko iske liye charge nahi kiya jayega.

Term Loan

Short term, long term aur intermediate term ke liye term loan liya ja sakta hai. Term loan 2 types ke hote hain- Secured business loans aur Unsecured business loans. Secured business loan lene ke liye apko bank ke paas collateral rakhwana padta hai aur Unsecured business loan ke liye kisi bhi prakar ke collateral ya security ki zarurat nahi padti. Secured business loans ka interest rate unsecured business loans ke comparison mein low hota hai.

Bill Discounting

Bill discounting ek instant cashback ka method hai. Iske liye apko bills of exchange dikhana padta hai jiske return mein aapko cash milta hai jo ki bill mein mentioned amount se kam hota hai. Isse avail karne ke liye apko kuch important documents ki zarurat padti hai jaise invoices, transportation receipts, etc.

Letter of Credit

Letter of Credit ko LC bhi kaha jata hai. Yeh generally international business ke liye use liya jata hai.

3. Women Entrepreneurs ke liye business loan schemes

Agar samaj mein yogdaan dene ki baat aaye toh mahilaaye kisi bhi tarah ka business sambhal sakti hain. Banks mahilaon ki inn capabilities ko samajh chuke hain aur ek successful business chalane wali women ko small business loans offer karte hain par iske liye unhe financial help ki zarurat nahi padti. Banks aur NBFCs jaisi financial institutions women entrepreneurs ke liye bahut si schemes laayi hai. Toh aaiye jante hain in schemes ke baare mein-

Cent Kalyani Scheme

Yeh scheme Central Bank dwara offer ki jati hai. Women naye business shuru karne ke liye loans le sakti hain. Naye ya experienced, sabhi types ki business owners, self employed aur professionals ko loan diya jata hai. Jo mahilaaye agricultural aur cottage industries ki field mein entrepreneurs hai , weh is scheme ke under loan le sakti hain.

Stree Shakti Package for Women Entrepreneurs

Yeh scheme un women entrepreneurs ko offer ki jaati hai jinki small business mein 50% tak ki ownership ho. Iske liye women entrepreneurs ko State agency dwara oragnise karwaye gaye Entrepreneurship Development Programmes (EDP) mein part lena padta hai. Iss scheme ke under women entrepreneurs ko 0.05% concession milta hai interest par lekin ye interest ka concession women tabhi avail kar sakti hain jab loan ka amount Rs 2,00,000 se zyada ho.

Dena Shakti Scheme

Yeh scheme Dena Bank dwara nikali gayi hai jiske dwara weh female entrepreneurs ko financial assistance provide kar ke female owned businesses ko promote karte hain. Iss scheme ke under loan lene par 0.25% ka concession milta hai interest rate par. Jo mahilaaye small enterprises, micro credit ya retail stores chalati hain, weh is scheme ke under loan avail kar sakti hain.

Udyogini Scheme

Yeh scheme Punjab and Sind bank dwara women entrepreneurs ko motivate karne ke liye offer ki gayi hai. Iss scheme ke under women entrepreneurs ko small scale industries establish karne ke liye unhe low interest rates par loans provide kiye jate hain. Retail traders aur self- employed women entrepreneurs ko bhi iss scheme ke under loan provide kiya jata hai.

Mahila Udyam Nidhi Scheme

Yeh scheme Small Industries Development Bank (SIDBI) dwara female entrepreneurs ko offer ki jati hai. Iss scheme ke under SIDBI dwara Rs 10,00,000 tak ka loan provide kiya jata hai taki women small scale sectors mein naye businesses shuru kar sakein.

Business Loan ke liye Eligibility Criteria

Ab hum yeh toh jaan chuke hain ki business loan hum bahut se sources ke through le sakte hain jaise ki Government schemes, bank loans aur women entrepreneurs ke liye special schemes. Aaiye ab jaante hain ki in schemes ke under loan lene ka eligibility criteria kya hota hai.

- Government Schemes ke under loan lene ki eligibility

The Credit Guarantee Scheme ki eligibility

Yeh scheme new aur existing, dono types ke MSMEs par applicable hai jo ki manufacturing ya services activities mein deal karti hain.

Mudra Loan Scheme ki eligibility

Non–corporate small business segment (NCSB) jisme rural aur urban areas ki proprietorship/ partnership firms included ho, iss scheme ke under loan ke liye apply kar sakti hai. NCSBs ke kuch examples hain jaise

- Small manufacturing units

- Service sector units

- Shopkeepers

- fruits/ vegetable vendors

- Truck operators

- Food- service units

- Repair shops

- Machine operators

- Small Industries

- Artisans

- Food processors etc

Sabhi types ki manufacturing, Trading aur Service Sector units ko iss sector ke under loan mil sakta hai.

Mudra Loan scheme ke baare mein jyada jaankari ke liye yahan click karein.

Stand-up India Scheme ki Eligibility

Jo enterprises manufacturing, trading services mein involved hain weh iss scheme ke under loan le sakti hain. Non Individual Enterprises ke case mein at least 51% ki shareholding aur controlling stake ek SC/ST ya Women Entrepreneur ke paas honi chahiye.Borrower ka kisi bhi bank ya financial institution ke sath koi payment mein default nahi hona chahiye.

Iss scheme ke baare mein jyada jaankari ke liye yahan click karein.

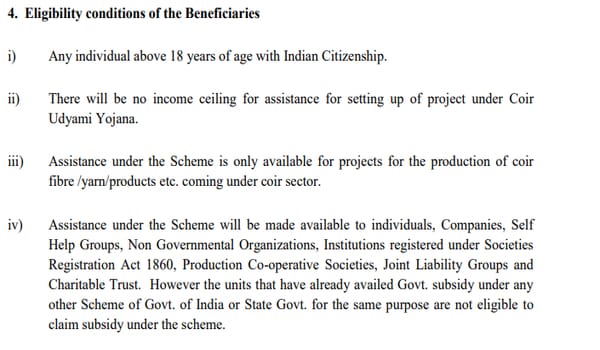

Coir Udyami Yojana Scheme Eligibility

Sabhi Coir Processing MSME Startups jo ki Coir Industry (Registration) Rules, 2008, ke tahat Coir Board ke under registered hain, iss scheme ke under loan lene ke liye eligible hain. Iska eligibility criteria hai-

1. Iss scheme ke under unn sabhi individuals, Companies, Self Help groups, NGOs , Institutions ko assistance provide ki jayegi jo Societies Registration Act, 1860 ke under registered hain. Production Cooperative Societies, Joint Liability Groups aur Charitable Trusts ko bhi business loan provide kiya jata hai.

2. Weh startups jo already government subsidy ya kis governmet scheme ke under iss facility ko avail kar chuke hain, weh iss scheme ke under business loan lene ke liye eligible nahi hai.

Iss scheme ke baare mei jyada jaankari ke liye yahan click karein.

2. Bank Business Loan ke liye eligibility

Sabse pehle jaante hain ke bank se business loan lene ke liye kaun kaunsi parties eligible hain-

a) Self-employed businessman aur professionals

b) Limited ya private limited firms

c) Manufactured, retailer ya service providers

Ab jaante hain ki bank se business loan lene ke liye eligibility criteria kya hota hai-

- Applicant ki age 21 – 65 years ke beech honi chahiye.

- Business kam se kam 3 saal tak existence mein hona chahiye.

- Business mein pichle 2 saalo se profit ho raha hona chahiye.

- Business ka turnover 40-50 lakhs per year hona chahiye.

- Minimum profit 1-2 lakhs tak hona chahiye.

3. Women Entrepreneur schemes ke liye Eligibility

Cent Kalyani Scheme | Stree Shakti Package Scheme | Dena Shakti Scheme | Udyogini Scheme | |

Eligibility | 18 saal se upar ki mahilaaye | Women entrepreneur ka business enterprise mein 51% ya usse zyada ki ownership honi chahiye. | Women entrepreneur ka business enterprise mein 50% ya usse zyada ki ownership honi chahiye. | Women entrepreneur ki age 18-55 ke beech honi chahiye aur income ceiling 1.5 lakhs hai. |

Business Loan ke liye Documents

Business loan lene ke liye humein bahut se documents ki zarurat padti hai lekin aapko kaunse documents ki zarurat padegi, Yeh iss baat par depend karta hai ki aap loan kahan se le rahe hain.

- Agar aap Government Schemes ke through Business Loan le rahe hain toh aapko har scheme ke liye ala documents chahiye honge lekin hum aapko kuch aise documents batayenge jo ki sabhi schemes ke liye common hain jaise-

- GST Identification Number

- Income tax ki details jo ki pichle 3-5 saalo mein pay kiya ho.

- Last 6 months ki bank statements

- Jis type ka aap loan lena chahte hain, uski proper details.

- Company/Partnership firm ke Directors ya partners ki list

- E- Kyc- Sabhi documents jinki applicant ko E-Kyc ke time zarurat padegi jaise ki Personal Id, Address proofs, Premise proof, Aadhar Number etc.

2. Agar aap Bank se business Loan lete hain toh aapko kuch documents ki zarurat padegi jaise-

- Pichle 3 saalo ka Income Tax Return (ITR)

- Bank Statements

- Business proof

- Certificate of Practice

- Applicant ki recent/latest photograph

- Identity proof jaise Aadhar Card, Voter Id Card, PAN Card, Company Registration Certificate etc

- Residence proof

- Other documents jaise Sole Proprietory Declaration, Partnership Deed ki Certified Copy, Memorandum of Association aur Articles of Association ki certified copy etc

3. Agar aap ek women entrepreneur hain aur aap women entrepreneurs ke liye banayi gayi government schemes ke dwara loan lena chahte hain toh aapko kuch documents ki zarurat padegi jaise-

- Identity proof- Aadhar Card, Driving License, Voter ID card, Passport,

- Address proof- Ration Card, Aadhar Card aur Passport

- Residence proof- Utility bills, landline bills, water bills

- Income proof- Pichle 2 saalo ki bank statements

- Financial Documents- Income Tax Returns (pichle 2 saalo ka), Pichle 2 saalo ki profit and loss statement, C.A. dwara audit ki gayi Balance Sheet.

- Business Ownership- Partnership business ke liye Partnership deed, Sole proprietor deed agar aap sole proprietor hain, Articles of Association, Memorandum of Association ki Certified copy

Business Loan ke liye apply kaise kare

Agar aap bank se business loan ke liye apply kar rahe hain, toh aap online aur offline dono tareeko se iss loan ke liye apply kar sakte hain-

Online Process

- Agar aapka financial lender yani ki bank online facility provide karta hai toh sabse pehle step hoga unki website ko visit karna.

- Unki website mein, loans section par jaakar , business loans ya small business loans ka option choose karein.

- Application form download karein aur usmein sabhi important details fill karein.

- Iske baad application form submit karein.

- Jab bank ki Customer Service Team se apko koi inform kare, toh apne form ko verification ke liye daal dein.

- Agar aap loan ke eligibility criteria ko match karte hain, toh aapka loan approve ho jayega aur thode hi dino mein apko aapke loan ka amount de lend kar diya jayega.

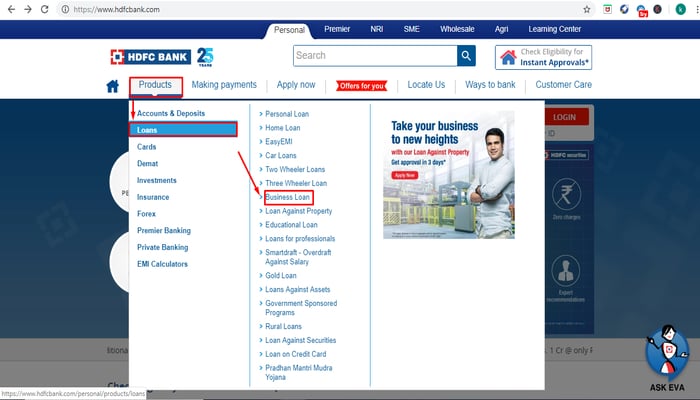

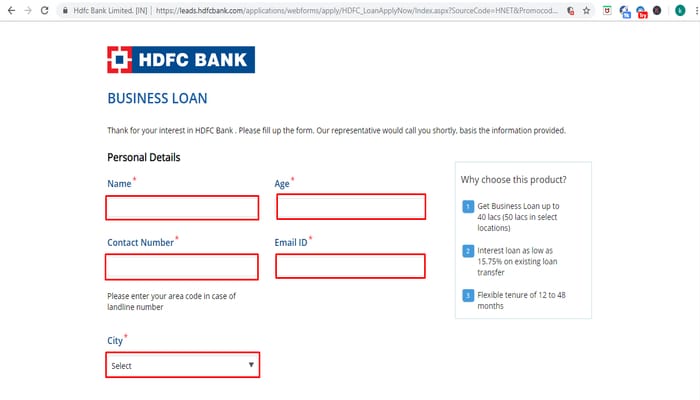

Example- Agar aap HDFC bank mein business loan ke liye online apply karte hain toh aapko kuch steps lene padenge jo humne pictures ki help se samjhaya hua hai-

Step 1. Sabse pehle aap HDFC bank ki website par jaaye. Products ke head mein jaa kar loans par click karein jiske andar aapko business loan ka option dikhega.

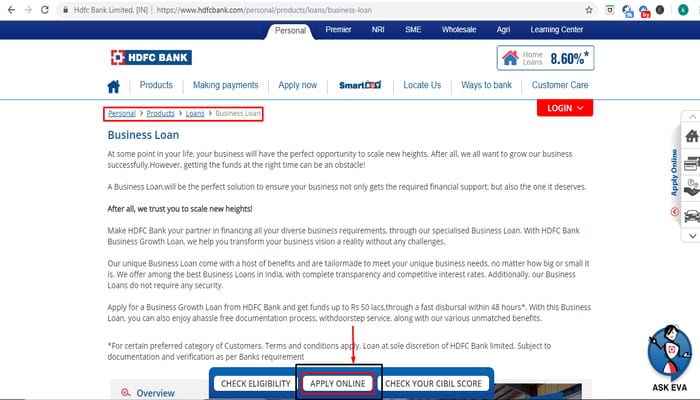

Step 2. ‘Business Loan’ ke option par click karne ke baad aap next page par land karenge jahan aapko ‘Apply Online’ ke naam se ek option dikhega. Uss option par click karein.

Step 3. ‘Apply online’ ke option par click karne ke baad next step hai apni personal details fill karna jaise ki Name, Age, Contact Number, Email- ID aur City

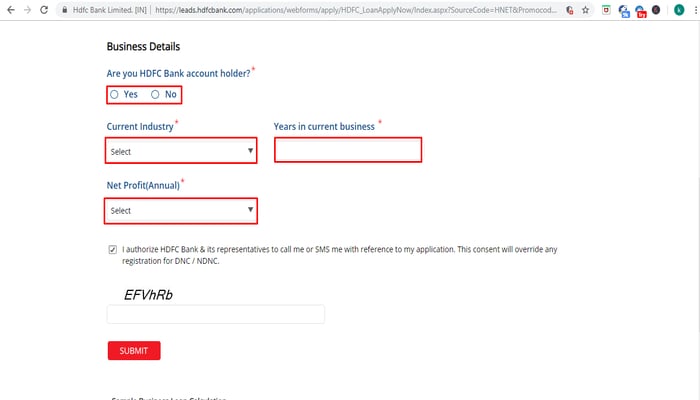

Step 4. Personal details fill karne ke baad next step hai apni Business Details bharna jismein apko bataana hoga ki aap HDFC bank ke user hai ya nahi, Current Industry, Years in Current business aur Annual Net Profit. Saari details fill karne ke baad ‘submit’ par click karein. Aapki online business loan application submit ho jayegi aur 24 hours ke andar aapko bank se call aa jayega.

Offline Process

- Sabse pehle apne bank ki branch ko visit kare aur wahan se application form le.

- Application form mein sabhi require details fill karein, form ko attest karein aur sabhi important documents submit karein.

- Uske baad lender yani ki bank apke sabhi documents ko verify karega.

- Agar aap loan ke eligibility criteria ko match karte hain, toh aapka loan approve ho jayega aur thode hi dino mein apko aapke loan ka amount de lend kar diya jayega.

Agar aap Government schemes ke through ya agar women entrepreneur schemes ke through Loan lena chahti hain to apply karne ka process hota hai-

- Jiss scheme ke through aap loan lena chahte hain, uss scheme ke online portal par jaayein.

- Portal par register karein aur One-Time Password (OTP) authentication ke through log in karein.

- Schemes ki Terms and Conditions par agree karein.

- Apne Financial Credentials aur baaki important information fill karein.

- Aage proceed karein aur required forms and details upload karein.

- Agar aap loan ke eligibility criteria ko match karte hain, toh aapka loan approve ho jayega aur thode hi dino mein apko aapke loan ka amount de lend kar diya jayega.

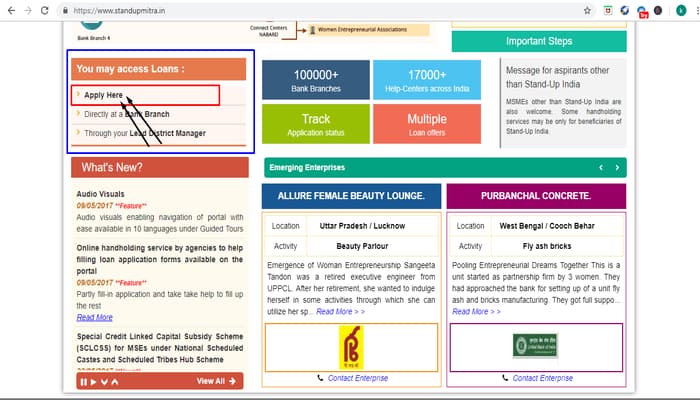

Example- Agar aap Stand-up India Scheme ke through business loan ke liye online apply karte hain toh aapko kuch steps lene padenge jo humne pictures ki help se samjhaya hua hai-

Step 1. Sabse pehle aap uss scheme ki online website par jaayein jis scheme ke through aap business loan lena chahte hain. Humne yahan aapko Stand-up India Scheme ka example diya hai jiske home page ki picture neeche de rakhi hai.

Step 2. Stand-up India ke home page par land hone ke baad neeche scroll down karein jahan aapko ‘You may access loans’ ka head dikhega. Uss head mein diye gaye ‘Apply here’ ke option par click karein.

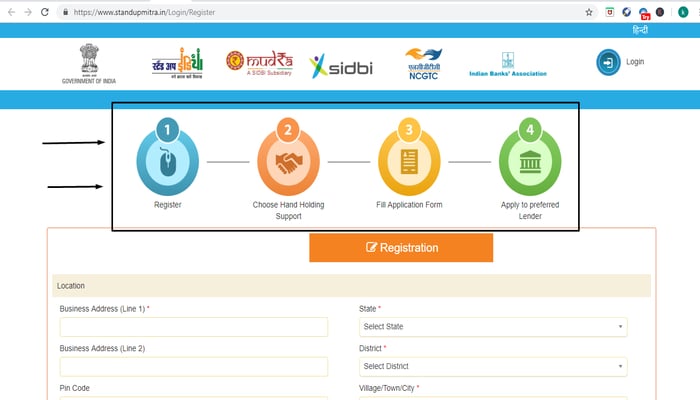

Step 3. ‘Apply Here’ par click karne ke baad sabse pehle aapko apne aap ko register karwana padega jiska form appear hota hai. Online registration form mein sari details fill karne ke baad aur submit karne ke baad, ‘Choose Hand Holding Support’ ka page aayega. Usmein details bharne ke baad aapko application form bharna hoga aur last step mein aapko apna preferred lender yani ki weh bank choose karna hoga jisse aap loan lena chahte hain.

Business Loan ke liye best banks

Ab aap business ke liye loan kaise le in hindi ke bare mein toh jaan chuke hain par ek sawaal jo hum sabhi ke man mein hai wo yeh hai ki kaunse bank se loan le. Loan lene se pehle ye decide karna bahut zaruri hai ki aap kis bank se business loan lena chahte hain aur yeh aap Interest Rate aur processing fees ke basis par decide kar sakte hain. Toh aaiye jaante hain aisi hi kuch banks ke naam-

Bank ka name | Business Loan Interest Rates | Processing fee |

State Bank of India | 11.20% | 2% se 3% |

HDFC Bank | 15.65% | 0.99% se shuru, Max. 2.50% |

ICICI Bank | 16.49% | 0.99% se 2% |

Bank of Maharashtra | 14.50% | Loan amount ka 1%, Min. Rs 1,000 |

Corporation Bank | 13.55% | 1.5%, Min. Rs 500 |

Punjab National Bank | 12.65% | 1.8% + taxes |

Dhan Laxmi Bank | 13.15% | |

Syndicate Bank | 12.65% | 0.5%, Min. Rs 500 |

Bank of Baroda | 14.10% | 1% tak |

Humne aapko kuch top banks ke names bataye hain jahan se aap business loan le sakte hain par aisa zaruri nahi hai ki business loans ke liye aap inhi banks ko prefer karein. Aap aur bhi bahut se banks ke interest rates ko compare kar ke decide kar sakte hain ki aap kahan se loan lena jaate hain. Iske alaawa baki banks ke interest rates janane ke liye yahan click karein.

NOTE- Business loan ke interest rates aapke business ke annual turnover, business kitne time se existence mein hai, aapne kitne loan amount ke liye apply kiya hai, repayment capacity etc par depend karta hai. Jitna zyada loan ka amount hoga, utna kam interest rate hoga.

Aapko iss article se business ke liye loan kaise le in hindi se judi puri jaankari mil gayi hogi ki aap Agar abhi bhi aapke business ke liye loan kaise le in hindi se jude kuch sawaal hain jinke jawab aap janana chahte hain, toh humse comment box mein jarur puchiye.